Significance of Retirement Savings

Retirement savings hold a crucial importance in securing financial stability during the golden years of one’s life. As individuals transition from active employment to retirement, having a dedicated fund set aside becomes essential to maintain a comfortable lifestyle without relying solely on government benefits or assistance from family members. By setting aside a portion of their income regularly into retirement accounts, individuals can build a nest egg that provides a sense of security and peace of mind for the future.Moreover, with the uncertainties of life, having retirement savings serves as a safety net against unforeseen expenses or emergencies that may arise during retirement. These funds act as a buffer to cover medical expenses, home repairs, or any other financial setbacks that could potentially disrupt the financial well-being of retirees. By prioritizing retirement savings early on and consistently contributing to these accounts, individuals can better prepare themselves for a financially secure and worry-free retirement phase.

Retirement calculator plays a crucial role in financial planning for retirement. By regularly contributing to retirement savings, individuals can build a secure nest egg to ensure a comfortable lifestyle and safeguard against unexpected expenses during their golden years.

theautomirror | mycollegeai | factsfuzz | Designhousewares | autodecade

Understanding Inflation and its Effects

Inflation is a concept that refers to the general increase in prices of goods and services over time. This means that over the years, the purchasing power of money decreases, leading to a decrease in the real value of savings and investments. Inflation is a normal economic phenomenon that occurs due to various factors such as increased demand, production costs, or changes in government policies.The effects of inflation can have a significant impact on retirees and their savings. As prices rise, the fixed income from retirement accounts may not be sufficient to cover expenses, leading to a decreased standard of living. Retirees may find it challenging to maintain their lifestyle and meet their financial obligations in the face of rising prices. It is crucial for retirees to understand the effects of inflation on their savings and plan accordingly to protect their financial well-being in retirement.

Challenges Faced by Retirees Due to Inflation

Retirees often face significant challenges due to the impact of inflation on their savings. As prices rise steadily over time, the purchasing power of retirees’ fixed incomes diminishes, making it more difficult to cover essential expenses such as healthcare, housing, and utilities. This erosion of purchasing power can lead retirees to have to make difficult choices, such as cutting back on discretionary spending or dipping into their savings, which may not be sustainable in the long run.Moreover, retirees who rely on fixed income investments, such as bonds or CDs, may find that the interest rates they receive are not keeping pace with inflation. This can further erode the real value of their investment returns, making it challenging to generate enough income to support their lifestyle. As a result, retirees may need to explore alternative investment strategies or consider adjusting their asset allocation to combat the effects of inflation on their retirement savings.

Strategies to Combat Inflation in Retirement Savings

To combat the effects of inflation on retirement savings, one effective strategy is to invest in assets that have historically outpaced inflation rates. This could include allocating a portion of the portfolio to stocks, real estate, or commodities. These assets have shown a tendency to provide returns that exceed the rate of inflation over the long term, helping to preserve the purchasing power of retirement funds.Another approach to combat inflation in retirement savings is to consider investing in Treasury Inflation-Protected Securities (TIPS). These government bonds are indexed to inflation, providing investors with a hedge against rising prices. By incorporating TIPS into a retirement portfolio, individuals can help ensure that their savings are not eroded by the effects of inflation over time.

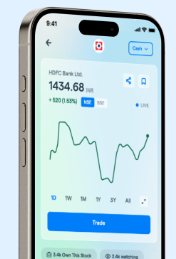

Open Demat Account Online To combat inflation in retirement savings, consider investing in assets like stocks, real estate, or commodities that historically outperform inflation. Another option is Treasury Inflation-Protected Securities (TIPS), which provide a hedge against rising prices and help preserve the purchasing power of retirement funds.

Importance of Diversification in Retirement Planning

Diversification in retirement planning is a critical aspect that helps mitigate risks associated with market fluctuations. By spreading investments across various asset classes, such as stocks, bonds, and real estate, individuals can reduce the impact of a downturn in any single sector. This strategy aims to provide more stable returns over the long term and safeguard retirement funds from significant losses that can result from over-reliance on a single investment type.Moreover, diversification also allows retirees to benefit from the potential growth of different sectors of the economy. For instance, while one asset class may experience a downturn, another may be thriving, balancing out the overall performance of the portfolio. This can help retirees maintain a steady income stream and preserve the value of their savings, ensuring financial stability during retirement.

Role of Interest Rates in Inflation Impact

Interest rates play a pivotal role in influencing inflation rates within an economy. When central banks adjust interest rates, it can impact the cost of borrowing money, which in turn affects consumer spending and business investment. Higher interest rates can lead to a decrease in borrowing and spending, thereby reducing the overall demand for goods and services. This decrease in demand can help to curb inflationary pressures within the economy by slowing down the rate at which prices rise.Conversely, lower interest rates tend to stimulate borrowing and spending, which can boost demand for goods and services. This increased demand can lead to upward pressure on prices, potentially fueling inflation. Central banks often use interest rate adjustments as a tool to manage inflation and promote economic stability. By understanding the relationship between interest rates and inflation, individuals can make informed decisions when planning for their retirement savings to mitigate the impact of inflation on their financial security.

Choosing the Right Investment Options for Retirement Savings

When it comes to choosing the right investment options for retirement savings, it is crucial to consider your risk tolerance, financial goals, and time horizon. Understanding the various investment vehicles available, such as stocks, bonds, mutual funds, and real estate, can help you create a diversified portfolio that aligns with your retirement objectives. Diversification is key to managing risk and maximizing returns over the long term.Another important factor to consider when selecting investment options for retirement savings is to pay attention to fees and expenses associated with each investment. High fees can eat into your returns significantly over time, so opting for low-cost investment options like index funds or exchange-traded funds (ETFs) can help you keep more of your money working for you. Additionally, staying informed about market trends and seeking professional advice can assist you in making informed decisions that support your retirement savings goals.

mutual fund Choosing the right investment options for retirement savings involves considering risk tolerance, financial goals, and time horizon. Diversifying your portfolio with stocks, bonds, and real estate can help manage risk and maximize long-term returns. Pay attention to fees and seek professional advice for informed decisions.

Long-Term Effects of Inflation on Retirement Funds

Inflation can have significant long-term effects on retirement funds. Over time, the purchasing power of money decreases due to inflation, leading to a reduction in the value of retirement savings. This means that retirees may find it challenging to maintain their desired standard of living as their savings may not stretch as far as they once did.Furthermore, the impact of inflation on retirement funds can be compounded by factors such as rising healthcare costs and increasing living expenses. As retirees depend on their savings to sustain them through their golden years, it is essential to consider the long-term effects of inflation and plan accordingly. Strategies such as investing in assets that outpace inflation and regularly adjusting retirement savings to account for inflation can help mitigate the erosion of purchasing power over time.

EducationYear | foodrecipetrick | letspartyblog | besteducationstips | lawproved

Planning for Healthcare Costs in Retirement

Healthcare costs can be a significant financial burden during retirement years. As individuals age, the need for medical care often increases, leading to higher expenses. It is crucial for retirees to plan ahead and consider the impact of healthcare costs on their overall financial situation. By factoring in potential medical expenses early on and creating a separate fund for healthcare, retirees can better prepare for any unforeseen medical needs that may arise.Moreover, understanding the various options for healthcare coverage, such as Medicare and supplemental insurance plans, is essential in ensuring adequate financial protection during retirement. By researching and comparing different healthcare plans, retirees can find the best coverage that suits their needs and budget. Additionally, staying proactive about managing health and wellness through preventive care can help reduce the likelihood of costly medical treatments in the future.

EducationYear | foodrecipetrick | letspartyblog | besteducationstips | lawproved

Factors to Consider When Adjusting Retirement Savings for Inflation

Inflation can significantly erode the purchasing power of retirement savings over time. When considering adjustments to retirement savings to combat the effects of inflation, it is crucial to take into account the rate of inflation and how it may impact the cost of living during retirement years. One important factor to consider is the historical inflation rate and potential future projections, as these can help retirees gauge the extent of adjustments needed to maintain their standard of living.Another factor to consider when adjusting retirement savings for inflation is the investment portfolio’s allocation. Diversification across different asset classes can help mitigate the impact of inflation on retirement funds. By spreading investments across a range of assets such as stocks, bonds, real estate, and commodities, retirees can better position their portfolios to withstand the effects of inflation and potentially generate returns that outpace inflation rates.

mf app Inflation can erode retirement savings. Consider historical inflation rates and future projections to adjust savings. Diversifying investment portfolios across asset classes can help combat inflation’s impact and potentially generate returns above inflation rates.